Annual Report

2021

President's Letter

Over the past year and a half, NICB has made incredible strides to accomplish our mission and bring additional value to our members.

We have prioritized evolving our association to better meet the changing needs

of our member companies and face emerging threats within the industry. This

evolution has required striking a balance between maintaining our existing

capabilities—such as auto recovery, that has direct, everyday value for our

members—with new capabilities in data analysis to better fight organized,

large-scale criminal networks that have a significant impact on our members

and their policyholders. It has also required incredible diligence and resilience

from our talented NICB team, who have undertaken the transformation of our

organization amidst continued challenges from the COVID-19 pandemic and

surges in insurance-related crime.

Last year, we moved from the assessment and information gathering phase of

2020 into a formal strategic planning process in 2021. I am proud to say we

met several critical milestones by the end of the year. We finalized our five-year

strategic plan, which provides the framework for 2022 and beyond. Significant

talent, with diverse backgrounds in insurance and law enforcement, was added

to our team, bolstering the already impressive skill sets of our existing staff.

We also restructured our association to better align with our evolving mission

and to ensure we continue to deliver on our core capabilities while bringing new

resources online.

In 2022, NICB is celebrating our 110th anniversary. This longevity

demonstrates the critical need for a non-profit organization like ours to exist—

one that can work in concert with the insurance industry, law enforcement, and

insurance regulators to effectively combat and deter insurance-related crime

and fraud.

Sitting at the intersection between law enforcement and the insurance industry,

NICB serves as the information sharing hub for the government and private

sector. We provide operational support to both, and importantly, we do so while

also complying with all legal and regulatory obligations.

In 2022, we have moved into the execution phase of our evolution, and I am

confident that we have successfully laid the foundation in 2020 and 2021 to

meet our objectives this year, all the while leading a united effort to combat and

prevent insurance crime through intelligence-driven operations.

Throughout our history, NICB has consistently provided real value to our

members by identifying, preventing, and deterring insurance crimes, reducing

losses, and facilitating asset recoveries. This part of our mission has not

and will not change. We continue to stay focused on delivering results to our

member companies.

David J. Glawe

President and Chief Executive Officer

Strategic Plan

Three Pillars

Beginning in June 2020 with CEO David Glawe’s arrival, NICB has undergone a thorough reexamination of all our ongoing operations. In addition to supporting a more robust data analytics operation, we are committed to improving all facets of the organization. The senior leaders in our organization have been tasked to commit significant time, resources, effort, and thought into how best to achieve that.

2021 was a consequential year in this pursuit, as we moved beyond the assessment and information gathering phase of 2020 into a formal strategic planning process last year. Having received strong endorsement from the NICB Board of Governors on our path forward, we have set the foundation for evolving NICB into a data-driven, predictive, crime-fighting organization that can provide members with our full suite of existing capabilities while increasing our service offerings through predictive analysis of crime trends. Finalizing our strategic plan was the top priority for the association in 2021 and provides the framework for our execution in 2022 and beyond.

NICB’s three pillars represent the mix of core competencies that drive strategic planning and execution. Guided by the objectives and priority actions under each of these pillars, NICB’s focus in the near future will be to execute on core competencies. The pillars, objectives, and priority actions serve as fundamental guideposts and will help steer NICB toward success.

NICB recognized that its strategic plan can only succeed through the coordinated and dedicated work of its employees, member companies, law enforcement partners, and strategic partners. NICB developed the plan by gathering information from member companies and law enforcement partners concerning the enduring criminal threats to insureds and incorporating feedback from NICB employees with substantial subject matter expertise on effective enterprise and departmental strategies to prevent and fight insurance crime.

Going forward, NICB will continue as a member- and partner-focused, flexible, and dynamic organization empowered to provide actionable intelligence and impactful operations and investigations to members and partners at all levels.

Intelligence, Analytics, and Operations

As the threats evolve, NICB will maintain its “boots on the ground” expertise and enhance its unique intelligence capabilities through technology-driven solutions and predictive analytics.

Education and Crime Prevention

NICB will serve as the Center of Excellence for insurance crime prevention, detection, and investigation.

Strategy, Policy, and Advocacy

Preserving NICB’s safe-harbor status through proper stewardship and responsible data use and sharing is fundamental to our success in fighting insurance crime.

Intelligence, Analytics, & Operations

Actionable Innovation

2021 was a year of continued, diligent support to our members and partners through joint investigations, intelligence sharing, analysis, and training, as well as an expansion of our partnerships and a modernization journey in the tools and techniques employed. Throughout 2021, the Office of Operations, Intelligence, and Analytics (OIA) ensured our efforts covered all sectors of importance, from vehicle theft to medical fraud to catastrophe response support.

OIA leveraged the team’s vast investigative experience, analytical talent, and subject matter expertise to publish comprehensive reports on global industry threats, including cargo theft, catastrophes, medical fraud, and general insurance fraud. Further, our team produced in-depth ForeCASTSM Reports on specific threats, such as vehicle theft, roofing fraud, COVID-19 fraud, identity theft, slip-and-fall fraud, and catalytic converter thefts.

Additionally, OIA collaborated with member companies and law enforcement partners across the country to combat a multitude of emerging trends. One example of this powerful collaboration was the successful long-term investigation of a CEO for a medical imaging company. This CEO was sentenced to 60 months in federal prison for running a scheme that submitted more than $250 million in fraudulent claims through the California Workers’ Compensation System for medical services procured through bribes and kickbacks to physicians and others.

As highlighted in the Insurance Fraud and Crime Trend Threat Assessment, top trends for medical investigations included medical provider fraud, staged/caused accidents, medical buildup networks, and illegal solicitation. OIA touched each of these sectors in their work.

To further serve members in the medical space, NICB expanded the diversity of provider specialties reported within NICB MedAWARE® Alerts. The 2021 MedAWARE Alerts amplified focus on specialties, such as orthopedic surgery, durable medical equipment, neurology, and pain management. This adjustment led to a wider variety of investigative leads for members and law enforcement.

Shifting to the vehicle space, car thefts have risen to levels not seen in decades. NICB continued to serve our members by assisting in the recovery of more than 29,000 vehicles valued at $134 million. The analytical team identified 655 vehicles involved in organized crime rings that were changing the vehicle identification numbers of these stolen vehicles to conceal the vehicle’s true identity.

In addition to a significant increase in car theft, we’ve also seen a spike in thefts of catalytic converters. The price increase for precious metals, coupled with economic factors and the increased opportunities for theft with more vehicles parked in driveways than on the road, created an environment where catalytic converter thefts became more desirable. OIA responded to this rise in catalytic converter thefts by supporting local, state, and federal law enforcement investigations targeting organized groups responsible for the theft and purchase of stolen catalytic converters. OIA additionally engaged with both state and federal legislators, as well as manufacturing partners, to address the issue of catalytic converter identification. Through continued partnership with several law enforcement agencies, NICB co-hosted crime prevention events where consumers could have their catalytic converters marked for easy identification to prevent future thefts.

Another example of OIA success in 2021 came from the publishing of a National Catastrophic Event Fraud Threat Assessment in July 2021, which predicted and shaped the direction of NICB’s Catastrophe Response Program. Some of the predictions of this report included an above-average hurricane season and an active fire season in California. Additionally, despite the difficulty in predicting severe weather and tornado outbreaks, OIA was able to precisely identify the top five CAT impact areas: Texas, Colorado, Louisiana, North Carolina, and Florida. Each of these states faced multiple catastrophic hazards due to the weather, making them particularly susceptible to fraud schemes. In 2021, NICB responded to 47 catastrophic events in order to support its members and law enforcement partners. Throughout the year, OIA disseminated 118 Catastrophe Alerts

including 68 leads on entities potentially involved in questionable hail damage, inflated damage, or vendor fraud activities.

None of these outstanding accomplishments would have been possible without a continued focus on our workforce and team members. OIA continued to develop professional capabilities with a robust training schedule in 2021. Team members attended open-source intelligence training, PostgreSQL1 training, multiple visualization training meetings, and had sessions specifically dedicated to NICB’s cloud environment. By sharpening our skills to keep pace with complex criminal schemes, NICB agents and analysts joined forces with member companies and state and federal law enforcement partners to successfully execute the largest New York no-fault automobile insurance fraud take down in history, which resulted in the arrest of 13 individuals for their alleged roles in a $100 million health care fraud, money laundering, and bribery scheme.

NICB’s senior data scientist leveraged the combined talent and expertise of our team to expand data modeling and automation capabilities and develop several analytical tools in order to increase the speed and accuracy of actionable investigative leads. One tool currently in pilot is a dashboard that focuses on detecting medical providers who may be billing for services not rendered. A second pilot dashboard identifies body shops, towing companies, and medical or legal providers who may be involved in suspicious high-occupant vehicle collisions. Additionally, an automated process to generate visual leads on potential organized ring activity within questionable claims is in testing.

NICB has also expanded its analytical capacity through the NICB-Verisk cloud initiative, which, upon completion, will allow more robust data collections, faster processing, and a more secure environment for the future.

With an eye toward the future, Operations, Intelligence, and Analytics will continue our modernization journey, seeking new ways to exploit unique intelligence, develop predictive analytics, and advance our technological capabilities.

1PostgreSQL: An open-source relational database supporting both SQL (relational) and JSON (non-relational) querying.

2021 Accomplishments

Education & Crime Prevention

Informing the Public

Under the arm of Education and Crime Prevention, NICB develops standardized training curriculum for entry-level to advanced analysts and investigators that keeps pace with emerging threats and industry needs. Externally, we are informing and engaging the public to increase insurance crime awareness and prevention.

Learning & Development

NICB’s internationally recognized expertise in investigating insurance-related crimes rightfully positions us to be the leader in training the industry in insurance crime prevention, detection, and prosecution. Our curriculum—the gold standard in the insurance field—continues to keep pace with NICB’s operations and intelligence gathering efforts to service members with state-of-the-art training.

The NICB Learning and Development (L&D) Department, in conjunction with the National Insurance Crime Training Academy (NICTA), continued to provide robust educational and training opportunities in 2021 for members, law enforcement partners, and key stakeholders. Consistent with the prior year due to COVID-19 restrictions, we continued to face challenges for in-person course instruction. However, innovative eLearning and virtually led courses were introduced, which ensured effective training across a wide spectrum of offerings. Unique educational opportunities for 2021 included an Intelligence Analyst Academy, which provided in-depth instruction on analytical products and resources associated with crime trends and threats, along with specialized training through NICB Fraud Academies and special sessions.

Key to the foundation of NICB’s L&D educational opportunities is the FraudSmart® program. Available to NICB member companies, FraudSmart provides weekly instructor-led training covering a wide variety of topics, such as vehicle-related fraud and theft, medical fraud, property crimes, and white-collar crime. For 2021, NICB instructors provided 388 virtual instructor-led courses with over 2,240 participants. The bi-weekly FraudSmart courses continue to be an effective educational tool, providing a snapshot into NICB subject matter expertise related to the prevention and investigation of insurance crime.

In conjunction with traditional FraudSmart instruction, NICB provided additional offerings through focused academies and specialized instruction throughout the year. Facilitated virtually, NICB fraud academies continued to be a popular venue for instruction related to current insurance crime and fraud trends. Fraud academies for Medical Investigators, Workers’ Compensation, and General Fraud were all highly attended in 2021, with over 700 combined participants. Other specialized course offerings included sessions on illegal telehealth enterprises, the intersection between workers’ compensation and human trafficking, and a dedicated insurance fraud prosecutors and member attorney meeting.

On-demand eLearning courses provided through NICTA also proved to be a key educational resource last year. NICB continued to maintain the NICTA eLearning platform with a catalog of 60 courses representing learning opportunities across a variety of topics: from basic insurance fraud investigations to more complex criminal schemes. NICTA offerings also included 10 snapshot courses, which provided focused instruction on current threats and fraud topics. Many of the NICTA courses meet certification standards to satisfy continuing education credits, and subscribers had the ability to integrate courses into their respective learning management systems (LMS). NICTA maintained 118,000 registered members with 92,000 courses taken in 2021 and earned an average review rating of 4.51 out of 5. While NICTA courses undergo continual review and renewal processes, in 2021, NICB L&D began a more in-depth course evaluation to ensure the highest quality of offerings.

Throughout 2021, NICB L&D remained committed to providing members, law enforcement, and stakeholders with current and relevant educational products. Looking forward into 2022 and beyond, the L&D team remains focused on engagement with industry representatives, investigators, and intelligence analysts to ensure instructional products continue to meet member needs in the fight against the most pervasive and current threats and trends.

Accomplishments

Public Affairs & Communications

Rooted in our well-established subject matter expertise, NICB leverages our credibility in the industry to effectively educate the public about various insurance crime-related risks. NICB continues to work closely with our members to develop strategic and targeted campaigns designed to prevent insurance crime.

Targeted Campaigns

NICB’s external education and awareness strategy includes media campaigns and other efforts designed to improve public awareness and increase crime prevention.

Catalytic converter thefts have been the story of the pandemic and continue to increase around the country. The increase in catalytic convert thefts has also garnered a great deal of local and national media attention. NICB Public Affairs and Communications released several news releases and blog articles in 2021 on this issue, including content explaining why catalytic converters are so sought after, and how consumers can protect their vehicles against such thefts. In recent years, the values of platinum, palladium, and rhodium—precious metals used in the construction of catalytic converters that change the environmentally hazardous exhaust emitted by an engine into less harmful gasses—have skyrocketed. This has contributed greatly to the 1,203 average catalytic converter thefts recorded per month when last reported by NICB’s Operations, Intelligence and Analytics.

Auto theft was another subject for external communications campaigns. This started early in 2021 highlighting the dramatic increases in auto thefts in 2020, with specific monthly breakdowns of auto thefts showing that thefts increased dramatically just weeks after COVID-19 lockdowns began. NICB’s Public Affairs and Communications team distributed a news release highlighting the auto theft problem followed shortly by a 17-outlet media tour across the country discussing the problem of auto thefts and ways to prevent them from occurring.

Later in the year, the Communications team arranged an interview with national outlet USA Today to discuss auto theft trends based on NICB’s annual “Hot Spots” report. This was followed up with an interview with CNBC’s Andrea Day, and “The News with Shepard Smith” for NICB’s “Hot Spots” and “Hot Wheels” reports. NICB President and CEO David Glawe was featured on this media tour and made appearances in USA Today in addition to participating in CNBC interviews.

These public awareness campaigns reinforce NICB’s status as the industry thought leader on insurance crime issues.

Partnerships

When battling insurance crimes, we believe there is strength in numbers. That is why NICB Public Affairs and Communications places great importance in enriching our relationships with law enforcement and industry trade groups.

Last year, NICB partnered with the Consumer Protection Coalition in Florida to tackle Assignment of Benefits auto glass scams. We also partnered with the Rocky Mountain Insurance Association (RMIA) on auto theft issues, namely “puffing.” With auto theft

being a major concern in Florida, we partnered with the Ft. Lauderdale Police Department on the issue of auto theft creating a news release for distribution, social media outreach, and signage development.

Print & Digital Communications

NICB Public Affairs and Communications produces numerous materials and touchpoints with consumers, members, and law enforcement. Our NICB Informer quarterly publication, now in its second full year, is a cornerstone piece for NICB subject matter experts to explore a variety of topics affecting the insurance industry. Each edition, we are providing original, intelligence-based content exclusively for executives and others dedicated to fighting insurance fraud and crime. The NICB Informer is circulated to executives at 240 member insurance companies and other member organizations (about 600 circulation). There is additional reach with our interactive digital version. In total, The NICB Informer digital editions received 10,910 views in 2021.

We are also sharing original content online on our NICB blog. Articles, posted regularly, are focused on timely consumer awareness issues and what the public can do to protect themselves from insurance fraud and crime. Our top performing blog articles, on topics such as catalytic converter theft, most-stolen vehicles, and roofing fraud, received over 12,300 total views.

What allows NICB’s Public Affairs and Communications to respond quickly to key issues is social media. Today, there are an estimated 221.6 million users on Facebook in the U.S., 81% of which are American adults—creating a vast audience for our organization to get the word out quickly on fraud. Through paid ads in 2021, we utilized the platform’s advanced geotargeting technology to bring consumers anti-fraud and theft resources down to the mile, targeting areas where fraud is particularly high.

Rounding out the NICB Public Affairs and Communications products, the new podcast series

launched in April, “The NICB Crime Examiner,” continues to gain traction, with three episodes that were produced in 2021. Auto theft, contractor fraud, and the evaluation of global risks and threats since 9/11 were all topic areas covered in great depth. In total, these three episodes have been streamed 1,081 times since posting.

In addition to the aforementioned products, dynamic videos produced by NICB Public Affairs and Communications continue to gain new audiences and spread the message about insurance fraud and crime. In 2021, we produced 69 videos, with the top performer being the “PSA (Spanish): Auto Theft w/ Keys (30 Seconds)” video with 3,539 views.

Contractor Fraud Awareness Week

NICB knows a thing or two about post-disaster fraud. Thus, in 2021, we kicked off the inaugural Contractor Fraud Awareness Week, dedicated to highlighting the problem of contractors and vendors who take advantage of disaster victims in the aftermath of a

catastrophe. Post-disaster fraud is a serious matter and the more voices we have to help spread the word on this problem, the more we can flush out bad actors. NICB members, partners, and industry trades were encouraged to sign up as partners to receive additional information on how their companies or agencies could help spread the message about dishonest contractors.

Highlights from the week included the release of OIA’s National Catastrophic Event Fraud Threat Assessment, a Twitter chat co-hosted by our partners at the AARP Fraud Watch Network, a nationwide crime prevention TV tour targeting areas of the country most at risk for catastrophic events, and a NICTA webinar on Contractor Fraud. The second annual Contractor Fraud Awareness Week is happening May 23–27, 2022 [www.nicb.org/ContractorFraudWeek].

2021 Accomplishments

Strategy, Policy, & Advocacy

Leading Legislation

The mission of the Office of Strategy, Policy, and Government Affairs (SPGA) is threefold:

- Formulate overarching external and internal NICB policy positions

- Coordinate organizational strategic planning

- Execute strategies to influence key policy issues before federal and state legislative and regulatory bodies

In 2021, SPGA helped develop and draft the five-year strategic plan, a critical milestone in the evolution of our organization. The strategic plan serves as the foundation to further enhance department strategies and refine individual performance plans that align with our overarching business strategy. SPGA also helped craft NICB’s overarching Data Strategy.

On the government affairs side, SPGA tracked 746 bills across 49 states and in Congress.

A few highlights of SPGA working to influence these core issues include:

- Providing expert testimony at two in-person city council hearings and leading efforts along with other strategic partners to enact a towing ordinance in Chicago to address pressing abuses in the city, ranked 2nd worst in the nation for reports of towing fraud and abuse.

- Collaborating closely with external partners to address a gap in insurance fraud investigations and prosecutions in South Carolina by successfully restructuring anti-fraud operations within the Department of Insurance, and by working with the General Assembly to approve $2 million in funding for investigations and prosecutions. This represents a 400% increase in fraud-fighting resources.

- Addressing the meteoric rise in catalytic converter thefts, SPGA worked with state legislators around the country over the course of the year, often in coordination with our strategic partners, to draft new laws and enhance existing ones to deter these crimes. SPGA also provided technical expertise to Congress in helping to draft a federal catalytic converter bill that was introduced in early 2022.

SPGA also focused on protecting our safe harbor status as a responsible steward for handling sensitive data ethically and safely. We tracked 40 consumer data privacy bills in 25 states, provided in-person testimony, and worked closely with legislators and their staff to suggest amendments in Virginia, New York, Ohio, Colorado, Washington state, and the District of Columbia.

SPGA likewise identified and addressed other policy measures aimed at restricting access to data—whether by NICB, law enforcement, or insurance industry members. For example, SPGA worked with legislators and regulators in Texas and New Mexico to fend off efforts attempting to limit responsible access to information protected under state and federal Driver’s Privacy Protection Act laws.

SPGA successfully organized and hosted the 2021 Virtual Dedicated Insurance Fraud Prosecutor Conference in December. The conference provided the opportunity for member company lawyers and dedicated fraud prosecutors to exchange ideas and best practices on how to better investigate and prosecute insurance fraud and crime cases.

SPGA executed our commitment to remain the world’s foremost expert on policy issues impacting insurance crime and fraud issues.

Accomplishments

Partner Engagement & Member Services

Providing Superior Service

The Partner Engagement and Member Services team plays an integral role in NICB’s relationships at every level. The team is committed to providing superior customer service and communicating NICB’s tangible and intangible benefits from the moment a prospective member or partner is identified, through their full onboarding process, and beyond. Through regular outreach and engagement, the Partner Engagement and Member Services department supports NICB’s goal of uniting the insurance industry in the fight against insurance crime.

Coming off the heels of a strong performance in 2020, despite the global pandemic, the Partner Engagement and Member Services team continued to grow membership in 2021. Over the course of the year, 14 new Active and Associate members joined the organization. In addition, our member retention rate was exceptional, receiving only one voluntary termination notice in 2021—down from eight in 2020. This is not only a testament to the hard work of the Partner Engagement and Membership team, but emblematic of the commitment to excellence throughout the entire organization.

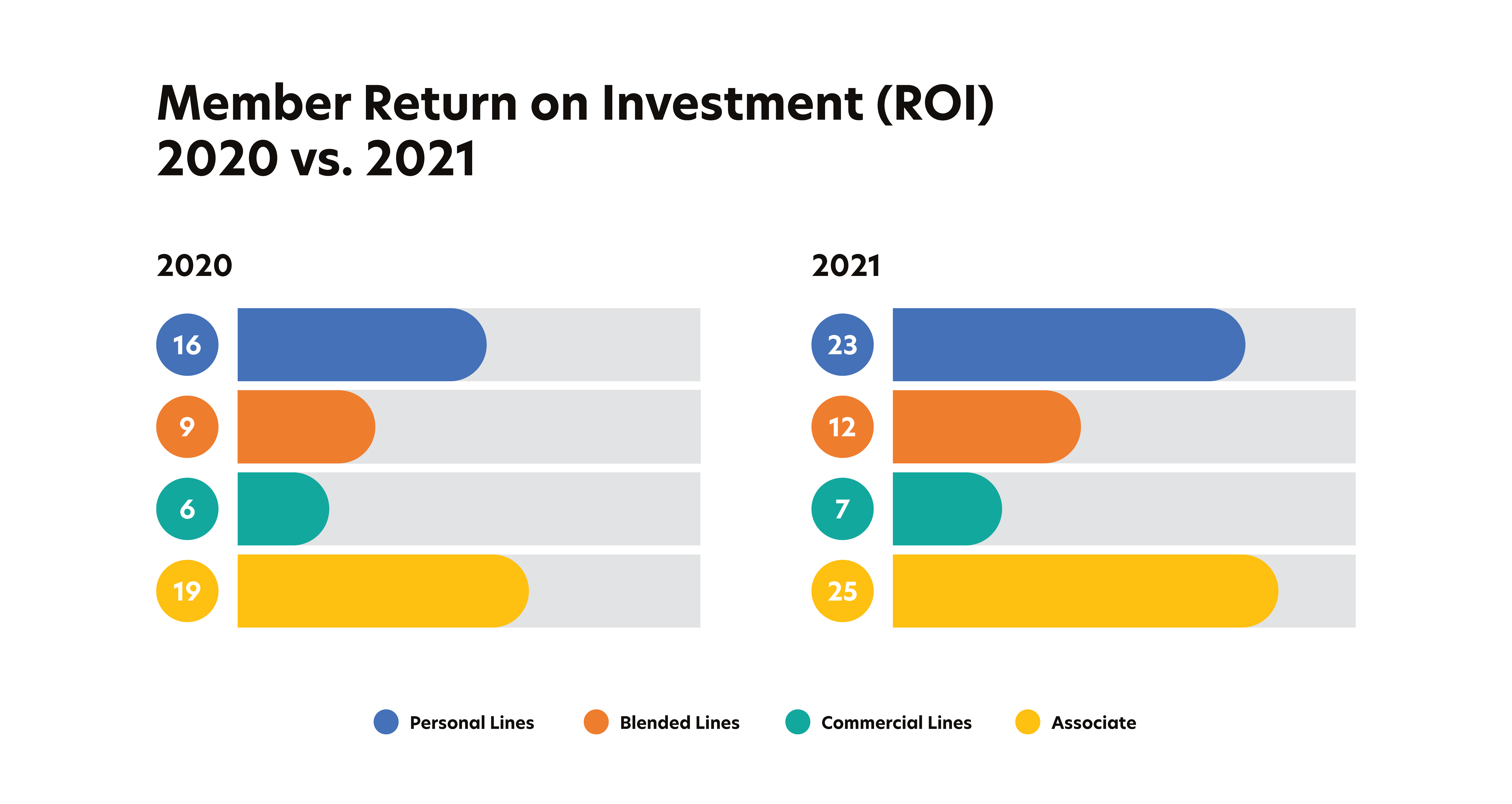

Current Active and Associate membership totals 249 groups, consisting of more than 1,200 property-casualty insurance companies and other organizations that support NICB’s mission. NICB’s ability to provide a strong measurable return on investment, in addition to other significant member benefits, has proven to be an influential selling point for prospective members. In 2021, based on lines of business, Active members enjoyed an average measurable ROI ranging from 7:1 to 23:1 and Associate members averaged a 25:1 return.

Partner Engagement and Member Services is committed to fostering and expanding membership and partnerships by providing quality service to members. One of the ways in which we achieve this is by staying engaged and actively seeking out and listening to feedback. In 2021, NICB established the SIU Leadership Advisory Group, providing an opportunity for SIU leaders to share their thoughts and advice on NICB’s evolution to an operationally focused and intelligence-driven organization. In addition, a Member Benefit Report (MBR) Committee was formed to evaluate the current metrics, categories, and value measures to ensure the MBR continues to capture accurate and material benefits to the membership.

The success of Partner Engagement and Member Services in 2021 has laid a great foundation for continued improvement and innovation in 2022. NICB’s biggest asset is the relationship we have with our members, and we are here to ensure that this connection stays strong.

2021 Key Statistics

Financials

2021 Statements

Statement of Financial Position

| Assets | |

|---|---|

| Current Assets | |

| 2021 | |

| $19,411,846 | |

| 2020 | |

| $16,033,339 | |

| Investments | |

| 2021 | |

| 57,856,750 | |

| 2020 | |

| 52,018,807 | |

| Property and Equipment, Net | |

| 2021 | |

| 592,473 | |

| 2020 | |

| 994,004 | |

| Other Assets | |

| 2021 | |

| 103,565 | |

| 2020 | |

| 115,222 | |

| Total Assets | |

| 2021 | |

| $77,964,634 | |

| 2020 | |

| $69,161,372 | |

| Assets | |

|---|---|

| Current Assets | |

| 2021 | $19,411,846 |

| 2020 | $16,033,339 |

| Investments | |

| 2021 | 57,856,750 |

| 2020 | 52,018,807 |

| Property and Equipment, Net | |

| 2021 | 592,473 |

| 2020 | 994,004 |

| Other Assets | |

| 2021 | 103,565 |

| 2020 | 115,222 |

| Total Assets | |

| 2021 | $77,964,634 |

| 2020 | $69,161,372 |

| Assets | |

|---|---|

| Current Assets | |

| 2021 | $19,411,846 |

| 2020 | $16,033,339 |

| Investments | |

| 2021 | 57,856,750 |

| 2020 | 52,018,807 |

| Property and Equipment, Net | |

| 2021 | 592,473 |

| 2020 | 994,004 |

| Other Assets | |

| 2021 | 103,565 |

| 2020 | 115,222 |

| Total Assets | |

| 2021 | $77,964,634 |

| 2020 | $69,161,372 |

| Assets | 2021 | 2020 |

|---|---|---|

| Current Assets | $19,411,846 | $16,033,339 |

| Investments | 57,856,750 | 52,018,807 |

| Property and Equipment, Net | 592,473 | 994,004 |

| Other Assets | 103,565 | 115,222 |

| Total Assets | $77,964,634 | $69,161,372 |

| Liabilities and Net Assets | |

|---|---|

| Current Liabilities | |

| 2021 | |

| $9,800,695 | |

| 2020 | |

| $9,771,679 | |

| Capital Lease Obligation, Net of Current Portion | |

| 2021 | |

| - | |

| 2020 | |

| 58,597 | |

| Other Long-Term Liabilities | |

| 2021 | |

| 198,214 | |

| 2020 | |

| 235,243 | |

| Accrued Post-Retirement Benefits, Net of Current Portion | |

| 2021 | |

| 17,615,000 | |

| 2020 | |

| 20,830,000 | |

| Total Liabilities | |

| 2021 | |

| 27,613,909 | |

| 2020 | |

| 30,895,519 | |

| Net Assets Without Donor Restrictions | |

| 2021 | |

| 50,340,188 | |

| 2020 | |

| 38,246,094 | |

| Net Assets With Donor Restrictions | |

| 2021 | |

| 10,537 | |

| 2020 | |

| 19,759 | |

| Total Liabilities and Net Assets | |

| 2021 | |

| $77,964,634 | |

| 2020 | |

| $69,161,372 | |

| Liabilities and Net Assets | |

|---|---|

| Current Liabilities | |

| 2021 | $9,800,695 |

| 2020 | $9,771,679 |

| Capital Lease Obligation, Net of Current Portion | |

| 2021 | - |

| 2020 | 58,597 |

| Other Long-Term Liabilities | |

| 2021 | 198,214 |

| 2020 | 235,243 |

| Accrued Post-Retirement Benefits, Net of Current Portion | |

| 2021 | 17,615,000 |

| 2020 | 20,830,000 |

| Total Liabilities | |

| 2021 | 27,613,909 |

| 2020 | 30,895,519 |

| Net Assets Without Donor Restrictions | |

| 2021 | 50,340,188 |

| 2020 | 38,246,094 |

| Net Assets With Donor Restrictions | |

| 2021 | 10,537 |

| 2020 | 19,759 |

| Total Liabilities and Net Assets | |

| 2021 | $77,964,634 |

| 2020 | $69,161,372 |

| Liabilities and Net Assets | |

|---|---|

| Current Liabilities | |

| 2021 | $9,800,695 |

| 2020 | $9,771,679 |

| Capital Lease Obligation, Net of Current Portion | |

| 2021 | - |

| 2020 | 58,597 |

| Other Long-Term Liabilities | |

| 2021 | 198,214 |

| 2020 | 235,243 |

| Accrued Post-Retirement Benefits, Net of Current Portion | |

| 2021 | 17,615,000 |

| 2020 | 20,830,000 |

| Total Liabilities | |

| 2021 | 27,613,909 |

| 2020 | 30,895,519 |

| Net Assets Without Donor Restrictions | |

| 2021 | 50,340,188 |

| 2020 | 38,246,094 |

| Net Assets With Donor Restrictions | |

| 2021 | 10,537 |

| 2020 | 19,759 |

| Total Liabilities and Net Assets | |

| 2021 | $77,964,634 |

| 2020 | $69,161,372 |

| Liabilities and Net Assets | 2021 | 2020 |

|---|---|---|

| Current Liabilities | $9,800,695 | $9,771,679 |

| Capital Lease Obligation, Net of Current Portion | - | 58,597 |

| Other Long-Term Liabilities | 198,214 | 235,243 |

| Accrued Post-Retirement Benefits, Net of Current Portion | 17,615,000 | 20,830,000 |

| Total Liabilities | 27,613,909 | 30,895,519 |

| Net Assets Without Donor Restrictions | 50,340,188 | 38,246,094 |

| Net Assets With Donor Restrictions | 10,537 | 19,759 |

| Total Liabilities and Net Assets | $77,964,634 | $69,161,372 |

Statement of Activities

| Revenue | |

|---|---|

| Assessments and Member Services | |

| 2021 | |

| $56,219,541 | |

| 2020 | |

| $55,286,904 | |

| Geospatial Member Assessment | |

| 2021 | |

| 10,042,829 | |

| 2020 | |

| 12,346,045 | |

| Data Related and Strategic Partnership | |

| 2021 | |

| 1,017,330 | |

| 2020 | |

| 1,047,282 | |

| Investment Return, Net | |

| 2021 | |

| 5,824,892 | |

| 2020 | |

| 4,015,487 | |

| Net Assets Released From Restriction | |

| 2021 | |

| 15,061 | |

| 2020 | |

| - | |

| Loss on Disposal of Property and Equipment | |

| 2021 | |

| (2,143) | |

| 2020 | |

| - | |

| Miscellaneous Income | |

| 2021 | |

| 5,214 | |

| 2020 | |

| 5,214 | |

| Total Revenues | |

| 2021 | |

| $73,123,174 | |

| 2020 | |

| $72,700,932 | |

| Revenue | |

|---|---|

| Assessments and Member Services | |

| 2021 | $56,219,541 |

| 2020 | $55,286,904 |

| Geospatial Member Assessment | |

| 2021 | 10,042,829 |

| 2020 | 12,346,045 |

| Data Related and Strategic Partnership | |

| 2021 | 1,017,330 |

| 2020 | 1,047,282 |

| Investment Return, Net | |

| 2021 | 5,824,892 |

| 2020 | 4,015,487 |

| Net Assets Released From Restriction | |

| 2021 | 15,061 |

| 2020 | - |

| Loss on Disposal of Property and Equipment | |

| 2021 | (2,143) |

| 2020 | - |

| Miscellaneous Income | |

| 2021 | 5,214 |

| 2020 | 5,214 |

| Total Revenues | |

| 2021 | $73,123,174 |

| 2020 | $72,700,932 |

| Revenue | |

|---|---|

| Assessments and Member Services | |

| 2021 | $56,219,541 |

| 2020 | $55,286,904 |

| Geospatial Member Assessment | |

| 2021 | 10,042,829 |

| 2020 | 12,346,045 |

| Data Related and Strategic Partnership | |

| 2021 | 1,017,330 |

| 2020 | 1,047,282 |

| Investment Return, Net | |

| 2021 | 5,824,892 |

| 2020 | 4,015,487 |

| Net Assets Released From Restriction | |

| 2021 | 15,061 |

| 2020 | - |

| Loss on Disposal of Property and Equipment | |

| 2021 | (2,143) |

| 2020 | - |

| Miscellaneous Income | |

| 2021 | 5,214 |

| 2020 | 5,214 |

| Total Revenues | |

| 2021 | $73,123,174 |

| 2020 | $72,700,932 |

| Revenue | 2021 | 2020 |

|---|---|---|

| Assessments and Member Services | $56,219,541 | $55,286,904 |

| Geospatial Member Assessment | 10,042,829 | 12,346,045 |

| Data Related and Strategic Partnership | 1,017,330 | 1,047,282 |

| Investment Return, Net | 5,824,892 | 4,015,487 |

| Net Assets Released From Restriction | 15,061 | - |

| Loss on Disposal of Property and Equipment | (2,143) | - |

| Miscellaneous Income | 5,214 | 5,214 |

| Total Revenues | $73,123,174 | $72,700,932 |

| Expenses | |

|---|---|

| Salaries | |

| 2021 | |

| $32,806,323 | |

| 2020 | |

| $33,002,103 | |

| Geospatial Imagery | |

| 2021 | |

| 9,428,335 | |

| 2020 | |

| 11,748,764 | |

| Retirement and Employee Benefits | |

| 2021 | |

| 6,909,458 | |

| 2020 | |

| 6,096,430 | |

| Payroll Taxes | |

| 2021 | |

| 2,406,990 | |

| 2020 | |

| 2,386,485 | |

| Dues and Fees | |

| 2021 | |

| 2,361,633 | |

| 2020 | |

| 2,057,371 | |

| Technical Fees and Services | |

| 2021 | |

| 2,037,147 | |

| 2020 | |

| 2,178,530 | |

| Automobile Operations | |

| 2021 | |

| 1,632,284 | |

| 2020 | |

| 1,542,060 | |

| Office Expense | |

| 2021 | |

| 1,377,793 | |

| 2020 | |

| 1,528,325 | |

| Computer and Peripheral Units | |

| 2021 | |

| 968,387 | |

| 2020 | |

| 729,434 | |

| Other | |

| 2021 | |

| 4,634,730 | |

| 2020 | |

| 4,715,563 | |

| Total Expenses | |

| 2021 | |

| $64,563,080 | |

| 2020 | |

| $65,985,065 | |

| Change in Net Assets Without Donor Restrictions Before Post-Retirement-Related Changes Other Than Net Periodic Post-Retirement Costs | |

| 2021 | |

| 8,560,094 | |

| 2020 | |

| 6,715,867 | |

| Post-Retirement Related Changes Other Than Net Periodic Post-Retirement Costs | |

| 2021 | |

| 3,534,000 | |

| 2020 | |

| (389,000) | |

| Total Change in Net Assets Without Donor Restrictions | |

| 2021 | |

| 12,094,094 | |

| 2020 | |

| 6,326,867 | |

| Contributions | |

| 2021 | |

| 5,839 | |

| 2020 | |

| 7,291 | |

| New Assets Released From Restriction | |

| 2021 | |

| (15,061) | |

| 2020 | |

| - | |

| Total Change in Net Assets With Donor Restrictions | |

| 2021 | |

| (9,222) | |

| 2020 | |

| 7,291 | |

| Change in Net Assets | |

| 2021 | |

| 12,084,872 | |

| 2020 | |

| 6,334,158 | |

| Net Assets, Beginning of Year | |

| 2021 | |

| 38,265,853 | |

| 2020 | |

| 31,931,695 | |

| Net Assets, End of Year | |

| 2021 | |

| $50,350,725 | |

| 2020 | |

| $38,265,853 | |

| Expenses | |

|---|---|

| Salaries | |

| 2021 | $32,806,323 |

| 2020 | $33,002,103 |

| Geospatial Imagery | |

| 2021 | 9,428,335 |

| 2020 | 11,748,764 |

| Retirement and Employee Benefits | |

| 2021 | 6,909,458 |

| 2020 | 6,096,430 |

| Payroll Taxes | |

| 2021 | 2,406,990 |

| 2020 | 2,386,485 |

| Dues and Fees | |

| 2021 | 2,361,633 |

| 2020 | 2,057,371 |

| Technical Fees and Services | |

| 2021 | 2,037,147 |

| 2020 | 2,178,530 |

| Automobile Operations | |

| 2021 | 1,632,284 |

| 2020 | 1,542,060 |

| Office Expense | |

| 2021 | 1,377,793 |

| 2020 | 1,528,325 |

| Computer and Peripheral Units | |

| 2021 | 968,387 |

| 2020 | 729,434 |

| Other | |

| 2021 | 4,634,730 |

| 2020 | 4,715,563 |

| Total Expenses | |

| 2021 | $64,563,080 |

| 2020 | $65,985,065 |

| Change in Net Assets Without Donor Restrictions Before Post-Retirement-Related Changes Other Than Net Periodic Post-Retirement Costs | |

| 2021 | 8,560,094 |

| 2020 | 6,715,867 |

| Post-Retirement Related Changes Other Than Net Periodic Post-Retirement Costs | |

| 2021 | 3,534,000 |

| 2020 | (389,000) |

| Total Change in Net Assets Without Donor Restrictions | |

| 2021 | 12,094,094 |

| 2020 | 6,326,867 |

| Contributions | |

| 2021 | 5,839 |

| 2020 | 7,291 |

| New Assets Released From Restriction | |

| 2021 | (15,061) |

| 2020 | - |

| Total Change in Net Assets With Donor Restrictions | |

| 2021 | (9,222) |

| 2020 | 7,291 |

| Change in Net Assets | |

| 2021 | 12,084,872 |

| 2020 | 6,334,158 |

| Net Assets, Beginning of Year | |

| 2021 | 38,265,853 |

| 2020 | 31,931,695 |

| Net Assets, End of Year | |

| 2021 | $50,350,725 |

| 2020 | $38,265,853 |

| Expenses | |

|---|---|

| Salaries | |

| 2021 | $32,806,323 |

| 2020 | $33,002,103 |

| Geospatial Imagery | |

| 2021 | 9,428,335 |

| 2020 | 11,748,764 |

| Retirement and Employee Benefits | |

| 2021 | 6,909,458 |

| 2020 | 6,096,430 |

| Payroll Taxes | |

| 2021 | 2,406,990 |

| 2020 | 2,386,485 |

| Dues and Fees | |

| 2021 | 2,361,633 |

| 2020 | 2,057,371 |

| Technical Fees and Services | |

| 2021 | 2,037,147 |

| 2020 | 2,178,530 |

| Automobile Operations | |

| 2021 | 1,632,284 |

| 2020 | 1,542,060 |

| Office Expense | |

| 2021 | 1,377,793 |

| 2020 | 1,528,325 |

| Computer and Peripheral Units | |

| 2021 | 968,387 |

| 2020 | 729,434 |

| Other | |

| 2021 | 4,634,730 |

| 2020 | 4,715,563 |

| Total Expenses | |

| 2021 | $64,563,080 |

| 2020 | $65,985,065 |

| Change in Net Assets Without Donor Restrictions Before Post-Retirement-Related Changes Other Than Net Periodic Post-Retirement Costs | |

| 2021 | 8,560,094 |

| 2020 | 6,715,867 |

| Post-Retirement Related Changes Other Than Net Periodic Post-Retirement Costs | |

| 2021 | 3,534,000 |

| 2020 | (389,000) |

| Total Change in Net Assets Without Donor Restrictions | |

| 2021 | 12,094,094 |

| 2020 | 6,326,867 |

| Contributions | |

| 2021 | 5,839 |

| 2020 | 7,291 |

| New Assets Released From Restriction | |

| 2021 | (15,061) |

| 2020 | - |

| Total Change in Net Assets With Donor Restrictions | |

| 2021 | (9,222) |

| 2020 | 7,291 |

| Change in Net Assets | |

| 2021 | 12,084,872 |

| 2020 | 6,334,158 |

| Net Assets, Beginning of Year | |

| 2021 | 38,265,853 |

| 2020 | 31,931,695 |

| Net Assets, End of Year | |

| 2021 | $50,350,725 |

| 2020 | $38,265,853 |

| Expenses | 2021 | 2020 |

|---|---|---|

| Salaries | $32,806,323 | $33,002,103 |

| Geospatial Imagery | 9,428,335 | 11,748,764 |

| Retirement and Employee Benefits | 6,909,458 | 6,096,430 |

| Payroll Taxes | 2,406,990 | 2,386,485 |

| Dues and Fees | 2,361,633 | 2,057,371 |

| Technical Fees and Services | 2,037,147 | 2,178,530 |

| Automobile Operations | 1,632,284 | 1,542,060 |

| Office Expense | 1,377,793 | 1,528,325 |

| Computer and Peripheral Units | 968,387 | 729,434 |

| Other | 4,634,730 | 4,715,563 |

| Total Expenses | $64,563,080 | $65,985,065 |

| Change in Net Assets Without Donor Restrictions Before Post-Retirement-Related Changes Other Than Net Periodic Post-Retirement Costs |

8,560,094 | 6,715,867 |

| Post-Retirement Related Changes Other Than Net Periodic Post-Retirement Costs |

3,534,000 | (389,000) |

| Total Change in Net Assets Without Donor Restrictions | 12,094,094 | 6,326,867 |

| Contributions | 5,839 | 7,291 |

| New Assets Released From Restriction | (15,061) | - |

| Total Change in Net Assets With Donor Restrictions | (9,222) | 7,291 |

| Change in Net Assets | 12,084,872 | 6,334,158 |

| Net Assets, Beginning of Year | 38,265,853 | 31,931,695 |

| Net Assets, End of Year | $50,350,725 | $38,265,853 |

These financial statements have been prepared by management in conformity with generally accepted accounting principles and include all adjustments which, in the opinion of management, are necessary to reflect a fair presentation. This presentation represents a summarization from audited financial statements. Certain reclassifications of prior year amounts have been made to conform to current year presentation.

NOTES TO FINANCIAL STATEMENTS

ASSESSMENT REVENUES

The activities of the National Insurance Crime Bureau (“NICB”), conducted principally in the United States, are financed through assessments of its member insurance carriers. Such assessments are determined according to a formula based upon gross premiums for certain lines of business written by member companies and annual verification received from them. During the years ended December 31, 2021 and 2020, nine member organizations made up approximately 55% and 53% of NICB’s assessment and member service revenues, respectively.

NET ASSETS WITHOUT DONOR RESTRICTIONS

Net assets without donor restrictions are not subject to donor-imposed stipulations or time restrictions.

NET ASSETS WITH DONOR RESTRICTIONS

Net assets with donor restrictions represent contributions subject to donor-imposed restrictions. These contributions are designated for special operations in support of law enforcement and fraud fighting activities.

GEOSPATIAL INTELLIGENCE

Geospatial Intelligence was developed to provide the insurance industry and others with comprehensive geospatial imagery “Gray Sky” and analytics related to natural or manmade catastrophic events that members may use to deal with insurance claims and prevent fraud.

The program platform delivers catastrophe monitoring and response, comprehensive “Blue Sky” aerial imagery coverage of the United States, and advanced analytics to include pre- and post-damage assessment to its members; leading to more claims decisions, reduction of fraud, and faster catastrophe response.

The scope of the program is dependent on special assessments from its members. NICB expended $10,172,972 and $12,467,308 to further develop the program, which includes $130,143 and $121,263 of indirect costs for the years ended December 31, 2021 and 2020, respectively.

NICB POST-RETIREMENT PLAN

NICB provides certain healthcare and life insurance benefits for retired employees. Employees hired prior to April 1, 2004 are eligible to receive this benefit. The NICB Post-retirement Plan is unfunded. As of December 31, 2021, recognition of the net unfunded status of the NICB Post-retirement Plan resulted in current liabilities of $756,000 and non-current liabilities of $17,615,000 for a total benefit obligation of $18,371,000.

LITIGATION

NICB has been named as a defendant in certain lawsuits wherein the plaintiffs seek to recover damages based upon various allegations arising from certain of these organizations’ investigations. After considering the merits of these actions and the opinions of outside counsel, together with the organizations’ liability insurance coverage, management of NICB believes that the ultimate liability for these matters, if any, will not have a material adverse effect on the NICB financial statements.

TAX STATUS

NICB has received a favorable determination letter from the Internal Revenue Service dated September 9, 1991, and reaffirmed in 2001, stating that it qualifies as a not-for-profit corporation as described in Section 501(c)(4) of the Internal Revenue Code (IRC) and, as such, is exempt from federal income taxes on related income pursuant to Section 501(a) of the IRC. NICB continues to qualify as a not-for-profit corporation under Section 501(c)(4).

Functional Program Expenses

| Intelligence and Analytics | |

|---|---|

| Strategic | |

| 2021 | |

| $3,720,504 | |

| 2020 | |

| $3,618,630 | |

| Tactical | |

| 2021 | |

| 2,564,192 | |

| 2020 | |

| 2,557,629 | |

| Information Aggregation and Analysis | |

| 2021 | |

| 1,850,787 | |

| 2020 | |

| 1,802,409 | |

| Total Intelligence and Analytics | |

| 2021 | |

| 8,135,483 | |

| 2020 | |

| 7,978,668 | |

| Intelligence and Analytics | |

|---|---|

| Strategic | |

| 2021 | $3,720,504 |

| 2020 | $3,618,630 |

| Tactical | |

| 2021 | 2,564,192 |

| 2020 | 2,557,629 |

| Information Aggregation and Analysis | |

| 2021 | 1,850,787 |

| 2020 | 1,802,409 |

| Total Intelligence and Analytics | |

| 2021 | 8,135,483 |

| 2020 | 7,978,668 |

| Intelligence and Analytics | |

|---|---|

| Strategic | |

| 2021 | $3,720,504 |

| 2020 | $3,618,630 |

| Tactical | |

| 2021 | 2,564,192 |

| 2020 | 2,557,629 |

| Information Aggregation and Analysis | |

| 2021 | 1,850,787 |

| 2020 | 1,802,409 |

| Total Intelligence and Analytics | |

| 2021 | 8,135,483 |

| 2020 | 7,978,668 |

| Intelligence and Analytics | 2021 | 2020 |

|---|---|---|

| Strategic | $3,720,504 | $3,618,630 |

| Tactical | 2,564,192 | 2,557,629 |

| Information Aggregation and Analysis | 1,850,787 | 1,802,409 |

| Total Intelligence and Analytics | 8,135,483 | 7,978,668 |

| Investigations | |

|---|---|

| Domestic Vehicle Recovery | |

| 2021 | |

| $4,265,119 | |

| 2020 | |

| $4,200,060 | |

| Repatriation | |

| 2021 | |

| 1,636,857 | |

| 2020 | |

| 1,606,927 | |

| Major Cases - Vehicle | |

| 2021 | |

| 1,861,290 | |

| 2020 | |

| 1,884,478 | |

| Major Cases - Property and Casualty | |

| 2021 | |

| 2,273,859 | |

| 2020 | |

| 2,288,512 | |

| Field Investigations | |

| 2021 | |

| 5,952,563 | |

| 2020 | |

| 5,892,344 | |

| Commercial Fraud | |

| 2021 | |

| 2,116,094 | |

| 2020 | |

| 2,087,757 | |

| Major Medical Fraud Task Forces | |

| 2021 | |

| 12,343,087 | |

| 2020 | |

| 12,433,156 | |

| Law Enforcement Assistance | |

| 2021 | |

| 4,023,064 | |

| 2020 | |

| 4,026,773 | |

| Total Investigations | |

| 2021 | |

| 34,471,933 | |

| 2020 | |

| 34,420,007 | |

| Investigations | |

|---|---|

| Domestic Vehicle Recovery | |

| 2021 | $4,265,119 |

| 2020 | $4,200,060 |

| Repatriation | |

| 2021 | 1,636,857 |

| 2020 | 1,606,927 |

| Major Cases - Vehicle | |

| 2021 | 1,861,290 |

| 2020 | 1,884,478 |

| Major Cases - Property and Casualty | |

| 2021 | 2,273,859 |

| 2020 | 2,288,512 |

| Field Investigations | |

| 2021 | 5,952,563 |

| 2020 | 5,892,344 |

| Commercial Fraud | |

| 2021 | 2,116,094 |

| 2020 | 2,087,757 |

| Major Medical Fraud Task Forces | |

| 2021 | 12,343,087 |

| 2020 | 12,433,156 |

| Law Enforcement Assistance | |

| 2021 | 4,023,064 |

| 2020 | 4,026,773 |

| Total Investigations | |

| 2021 | 34,471,933 |

| 2020 | 34,420,007 |

| Investigations | |

|---|---|

| Domestic Vehicle Recovery | |

| 2021 | $4,265,119 |

| 2020 | $4,200,060 |

| Repatriation | |

| 2021 | 1,636,857 |

| 2020 | 1,606,927 |

| Major Cases - Vehicle | |

| 2021 | 1,861,290 |

| 2020 | 1,884,478 |

| Major Cases - Property and Casualty | |

| 2021 | 2,273,859 |

| 2020 | 2,288,512 |

| Field Investigations | |

| 2021 | 5,952,563 |

| 2020 | 5,892,344 |

| Commercial Fraud | |

| 2021 | 2,116,094 |

| 2020 | 2,087,757 |

| Major Medical Fraud Task Forces | |

| 2021 | 12,343,087 |

| 2020 | 12,433,156 |

| Law Enforcement Assistance | |

| 2021 | 4,023,064 |

| 2020 | 4,026,773 |

| Total Investigations | |

| 2021 | 34,471,933 |

| 2020 | 34,420,007 |

| Investigations | 2021 | 2020 |

|---|---|---|

| Domestic Vehicle Recovery | $4,265,119 | $4,200,060 |

| Repatriation | 1,636,857 | 1,606,927 |

| Major Cases - Vehicle | 1,861,290 | 1,884,478 |

| Major Cases - Property and Casualty | 2,273,859 | 2,288,512 |

| Field Investigations | 5,952,563 | 5,892,344 |

| Commercial Fraud | 2,116,094 | 2,087,757 |

| Major Medical Fraud Task Forces | 12,343,087 | 12,433,156 |

| Law Enforcement Assistance | 4,023,064 | 4,026,773 |

| Total Investigations | 34,471,933 | 34,420,007 |

| Learning & Development | |

|---|---|

| Member Company Training | |

| 2021 | |

| 1,132,774 | |

| 2020 | |

| 1,125,056 | |

| Law Enforcement Training | |

| 2021 | |

| 1,081,042 | |

| 2020 | |

| 1,070,339 | |

| Internal training | |

| 2021 | |

| 635,640 | |

| 2020 | |

| 647,038 | |

| NICTA | |

| 2021 | |

| 665,959 | |

| 2020 | |

| 673,928 | |

| Total Learning & Development | |

| 2021 | |

| 3,515,415 | |

| 2020 | |

| 3,516,361 | |

| Learning & Development | |

|---|---|

| Member Company Training | |

| 2021 | 1,132,774 |

| 2020 | 1,125,056 |

| Law Enforcement Training | |

| 2021 | 1,081,042 |

| 2020 | 1,070,339 |

| Internal training | |

| 2021 | 635,640 |

| 2020 | 647,038 |

| NICTA | |

| 2021 | 665,959 |

| 2020 | 673,928 |

| Total Learning & Development | |

| 2021 | 3,515,415 |

| 2020 | 3,516,361 |

| Learning & Development | |

|---|---|

| Member Company Training | |

| 2021 | 1,132,774 |

| 2020 | 1,125,056 |

| Law Enforcement Training | |

| 2021 | 1,081,042 |

| 2020 | 1,070,339 |

| Internal training | |

| 2021 | 635,640 |

| 2020 | 647,038 |

| NICTA | |

| 2021 | 665,959 |

| 2020 | 673,928 |

| Total Learning & Development | |

| 2021 | 3,515,415 |

| 2020 | 3,516,361 |

| Learning & Development | 2021 | 2020 |

|---|---|---|

| Member Company Training | 1,132,774 | 1,125,056 |

| Law Enforcement Training | 1,081,042 | 1,070,339 |

| Internal training | 635,640 | 647,038 |

| NICTA | 665,959 | 673,928 |

| Total Learning & Development | 3,515,415 | 3,516,361 |

| Other Program Services | |

|---|---|

| Strategy, Policy, and Government Affairs | |

| 2021 | |

| 2,077,649 | |

| 2020 | |

| 1,499,698 | |

| Communications | |

| 2021 | |

| 1,638,007 | |

| 2020 | |

| 1,754,150 | |

| Geospatial Intelligence | |

| 2021 | |

| 10,172,972 | |

| 2020 | |

| 12,467,308 | |

| Total Program Services | |

| 2021 | |

| 60,011,459 | |

| 2020 | |

| 61,636,192 | |

| Administrative & General | |

| 2021 | |

| 4,551,621 | |

| 2020 | |

| 4,348,873 | |

| Total Functional Expenses | |

| 2021 | |

| $64,563,080 | |

| 2020 | |

| $65,985,065 | |

| Other Program Services | |

|---|---|

| Strategy, Policy, and Government Affairs | |

| 2021 | 2,077,649 |

| 2020 | 1,499,698 |

| Communications | |

| 2021 | 1,638,007 |

| 2020 | 1,754,150 |

| Geospatial Intelligence | |

| 2021 | 10,172,972 |

| 2020 | 12,467,308 |

| Total Program Services | |

| 2021 | 60,011,459 |

| 2020 | 61,636,192 |

| Administrative & General | |

| 2021 | 4,551,621 |

| 2020 | 4,348,873 |

| Total Functional Expenses | |

| 2021 | $64,563,080 |

| 2020 | $65,985,065 |

| Other Program Services | |

|---|---|

| Strategy, Policy, and Government Affairs | |

| 2021 | 2,077,649 |

| 2020 | 1,499,698 |

| Communications | |

| 2021 | 1,638,007 |

| 2020 | 1,754,150 |

| Geospatial Intelligence | |

| 2021 | 10,172,972 |

| 2020 | 12,467,308 |

| Total Program Services | |

| 2021 | 60,011,459 |

| 2020 | 61,636,192 |

| Administrative & General | |

| 2021 | 4,551,621 |

| 2020 | 4,348,873 |

| Total Functional Expenses | |

| 2021 | $64,563,080 |

| 2020 | $65,985,065 |

| Other Program Services | 2021 | 2020 |

|---|---|---|

| Strategy, Policy, and Government Affairs | 2,077,649 | 1,499,698 |

| Communications | 1,638,007 | 1,754,150 |

| Geospatial Intelligence | 10,172,972 | 12,467,308 |

| Total Program Services | 60,011,459 | 61,636,192 |

| Administrative & General | 4,551,621 | 4,348,873 |

| Total Functional Expenses | $64,563,080 | $65,985,065 |

Leadership

Board of Governors, Advisors, & Senior Leadership

Board of Governors

Advisors to the Board

NICB Senior Leadership