The New Normal: Holiday Shopping Online

It’s that time again! This week, the holiday shopping season officially begins. Over the past few years, more and more people have decided to shop online. In fact, Cyber Monday 2019 made history as it was the biggest online shopping day ever, according to Statista. This year, we can only assume the number of online shoppers will increase.

Even though this year may look and feel different, theft tactics haven’t changed. Thieves are ready and waiting to hack online accounts and steal your information.

It’s important to take appropriate security measures and follow the proper steps to protect yourself from becoming a victim.

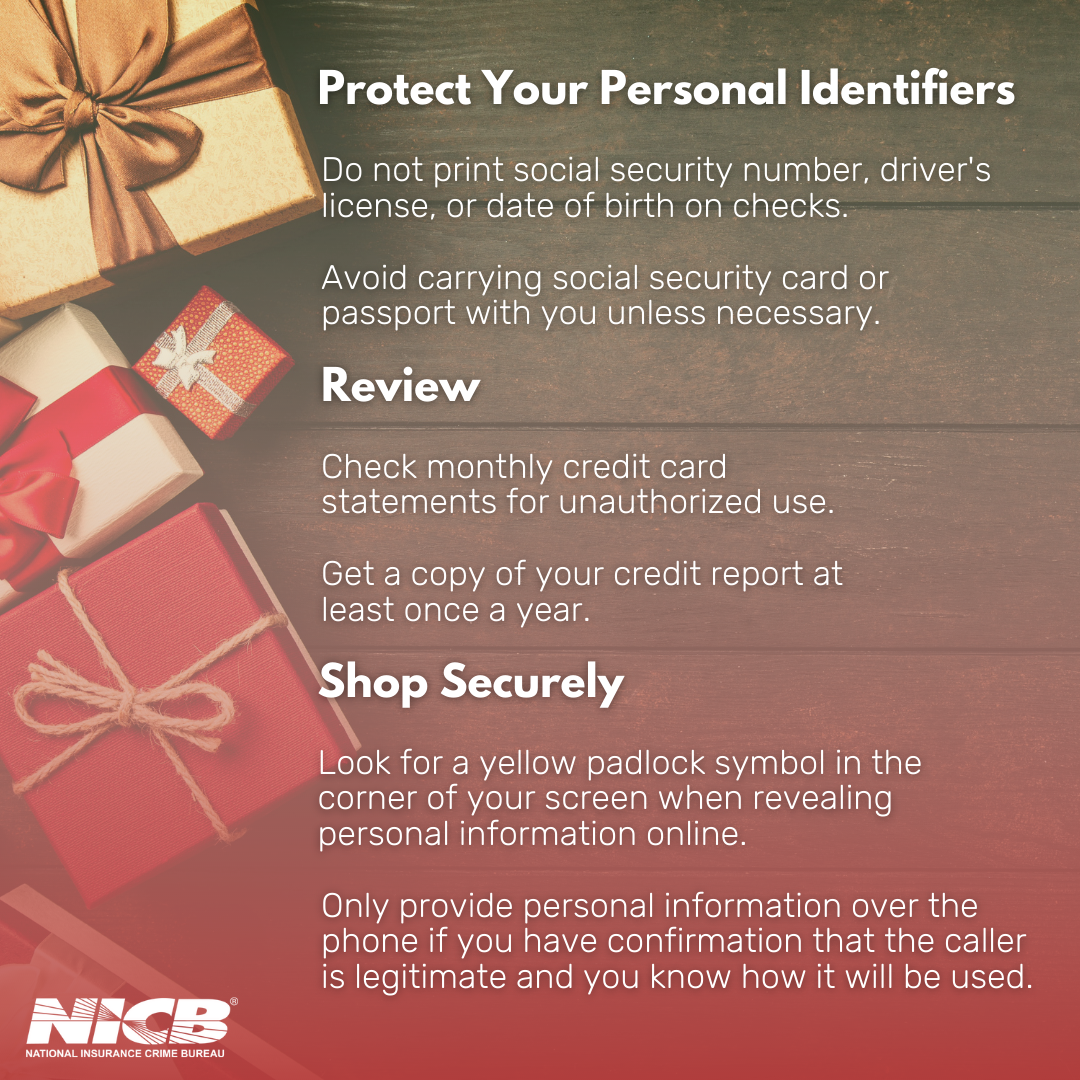

Tips to Avoid Falling Victim to Identity Fraud:

- Shred or tear up personal financial documents before discarding them.

- Do not print personal identifiers, such as your social security number, date of birth or driver’s license number on your checks.

- Use your social security number only when absolutely necessary.

- Only reveal information online when the website is securely protected (look for a yellow padlock symbol in the corner of your computer screen).

- Do not provide personal, financial or any other identifying information to a telephone caller. Ask for the caller’s name and telephone number, and then check to see that the caller is legitimate.

- Pay attention to your credit card billing cycles, as identity thieves may reroute bills to another address to hide criminal activities involving your accounts.

- Carefully review all monthly credit card statements and check for unauthorized use.

- Get a copy of your credit report at least once a year to check for possible errors.

- Minimize the number of cards and identifying information you carry, especially your social security card and passport.

- Before revealing any information – online, over the phone or in person – ask how it will be used.