Annual Report

2023

A Catalyst for Transformation

President's Letter

Over the past 12 months, NICB has made great progress toward achieving the ambitious vision and objectives set out for us as part of the strategic plan that the organization implemented three years ago. Our commitment to our core values of preventing and prosecuting insurance fraud and an emphasis on operational excellence helped us not only achieve these strategic objectives but also laid a strong foundation for growth in the years to come.

NICB’s focus on advancing our data analytics capabilities has allowed our team of analysts to quickly deliver reliable intelligence products that inform members, law enforcement, and the public on the latest trends and emerging insurance fraud threats. This has also provided our world-class field agents with timely and relevant information for investigations in the fight against fraud.

In addition to our primary organizational objective of growing our data analytics capabilities, last year NICB continued its work in partnering with state and federal law enforcement agencies to disrupt criminal networks and help recover vehicles for our member companies. We participated in task forces, fusion centers, and intelligence groups to fight fraud wherever it occurred and worked strategically with lawmakers and regulators in all 50 states to boost efforts by insurers and law enforcement to fight insurance fraud. We also continued our focus on expanding educational opportunities for our members with record-breaking course enrollments as part of the National Insurance Crime Training Academy (NICTA) and other training programs.

Our industry continues to face challenges from all sides, from the increase of catastrophic-related weather events—which provide new opportunities for fraudulent activities—to new and constantly evolving fraud tactics and schemes by organized criminal enterprises. One of these new challenges is found in the rise of artificial intelligence (AI), which has brought with it a new form of fraud that threatens to test the insurance industry like never before.

New advances in technology come with new risks and new responsibilities. While the misuse of AI can pose a real threat to the insurance industry, the use of AI in insurance crime investigation, when used correctly and responsibly, can also serve as a transformative force for our industry. AI has great positive potential for NICB and our members, offering advanced analytical capabilities that can sift through massive datasets, detect hard-to-find fraud patterns, and uncover anomalies that might indicate criminal activities.

NICB is embracing this new technology as it revolutionizes the landscape of the insurance industry, particularly in the realm of fraud detection and prevention. We are proud to help usher in a new era where advanced technologies are deployed to identify, mitigate, and combat fraudulent activities.

At the heart of NICB’s success is our pursuit of excellence when it comes to providing outstanding service to our members and partners. One of NICB’s many strengths is its powerful collaboration with member companies, government leaders, and law enforcement. These partnerships help drive innovation and result in more effective techniques to address insurance fraud. Working together, we will continue to grow and evolve as an organization that is committed and focused on combating insurance fraud in all its forms.

I encourage you to continue reading our 2023 Annual Report for more information on these topics, and you’ll learn about how our organization is evolving and moving forward to benefit members, law enforcement, and the entire insurance industry.

David J. Glawe

President and Chief Executive Officer

Operations, Intelligence, and Analytics

Actionable Innovation

In 2023, Operations, Intelligence, and Analytics (OIA) strategically focused its efforts on enhancing its capabilities, to include:

- Improving the quality, relevancy, availability, timeliness, and catalogue of intelligence products, which increase access to unique datasets.

- Standardizing internal business processes.

- Enhancing data management and automation processes and establishing machine learning in analytical reporting and forecasting.

- Strengthening data quality through entity resolution.

- Developing analytical tools relevant to combatting fraud.

- Driving operational outcomes in investigations.

The streamlining of resources, collaborative initiatives, and introduction of new products represent noteworthy advancements in providing valuable services to the insurance industry.

In 2023, OIA strengthened relationships and expanded collaboration efforts. NICB was granted access to the National Data Exchange (N-DEx)—the FBI’s unclassified criminal justice information sharing system—which allows NICB to search and receive alerts on subjects of interest from law enforcement agencies across the nation.

The Data Science team developed an entity resolution solution that allows NICB to better determine which records are referencing the same individual. The machine learning model regarding medical providers who may be engaging in fraudulent activity was refined, which led to the initiation of over 60 new investigations.

The team also developed a forecasting model to be able to accurately predict the rates of vehicle thefts expected in areas. This model has been incorporated into multiple intelligence reports for our members and has allowed for better coordination in targeting expected peak geographic locations.

NICB's Intelligence Management System (IMS) modernization effort, initiated in the summer of 2022, reached a significant milestone in July 2023 when the new system was deployed. Over two decades of NICB intelligence data was migrated to a secure cloud-based solution, and IMS will be pivotal in integrating intelligence equities while enhancing access for field resources. The successful deployment of the IMS signifies NICB's commitment to utilizing technology for intelligence-driven operations.

NICB’s Catastrophe (CAT) Response program continued to improve and advance its support for catastrophic events. OIA upgraded both technology and techniques in 2023 to geocode CAT claims for use by our partners at the Geospatial Insurance Consortium (GIC) to capture imagery more quickly and precisely. OIA also began re-processing models once claims have matured, increasing the opportunity to identify CAT-related fraud.

OIA improved its review and approval process for special and major investigations to improve customer service and hosted cargo theft and VIN etching events and a workers’ compensation conference to discuss the latest methods and challenges concerning commercial investigations. These efforts improved the capabilities of members to address fraudulent schemes and resulted in successes around the nation, including the resolution of 53 cargo theft investigations and instruction during 57 VIN etching events.

NICB remains committed to addressing all forms of fraud related to its vehicle program. OIA ended 2023 with 309,593 vehicle recoveries and 2,875 vehicle repatriations and provided vehicle crime training to member companies and law enforcement. OIA also launched an innovative effort to address the impact of organized crime rings and continues to explore other preventative measures designed to reduce insurance-related fraud and crime.

In addition, NICB is working to identify additional avenues for sharing our intelligence reports. This increased access to unique datasets, which are normally only available to law enforcement, and the ability to share intelligence allows NICB to provide better service and have a greater impact on fraud for our members.

In 2023, NICB was granted access to the National Data Exchange (N-DEx), which allows NICB to search and receive alerts on subjects of interest from law enforcement agencies across the nation.

Accomplishments

Education and Crime Prevention

Informing the Public

In 2023, Learning and Development (L&D) continued on our ever-evolving path to provide robust learning opportunities that empower our members, law enforcement partners, and key stakeholders in the fight against insurance crime and fraud. At the heart of L&D is a transformative process tailored to provide unique and effective offerings, which foster a culture of continuous learning. Notably, L&D remained steadfast on a long-range plan to evolve and elevate all educational programs. This was demonstrated through the modernization of FraudSmart® instructor-led courses and National Insurance Crime Training Academy (NICTA) eLearning modules with curriculum that reflect best practices and accommodate for diverse learning preferences and backgrounds.

Learning & Development

In addition, L&D provided relevant training through multiple virtual and in-person academies, which focused on a variety of topics to include vehicle crimes, medical fraud, and workers’ compensation fraud. Through tailored programs, strategic partnerships, and innovative initiatives, L&D continues to foster an environment of perpetual learning and ensuring the collective capabilities of our members and partners remain at the forefront of industry excellence.

FraudSmart Instructor-Led Courses

An enduring foundation of L&D offerings involves robust bi-weekly virtual instructor-led FraudSmart training. With a focus on comprehensive coverage of diverse insurance crime topics, and the ability to provide timely instruction related to emerging insurance crime trends, FraudSmart creates a dynamic and impactful learning experience for participants. FraudSmart courses are taught by NICB subject matter experts who bring a depth of knowledge, practical insights, and a real-world perspective. The ability for interactive discussions and use of polls and quizzes facilitates real-time interaction between learners and instructors and ensures an engaging learning experience. The FraudSmart program delivered 160 courses on a wide variety of fraud topics, such as vehicle crime, medical billing fraud, arson for profit, telehealth fraud, and identity theft. In 2023, L&D launched five new FraudSmart courses, updated 11 existing courses with fresh content and format, and processed over 1,700 continuing education credits, which supported NICB member professional development.

Specialized Academies

In a rapidly evolving insurance crime landscape, specialized academies afford participants an opportunity to receive targeted and up-to-date training that reflects the latest trends impacting the industry. L&D has achieved tremendous success through the production of academies, which facilitate the transfer of institutional knowledge by providing a structured platform for sharing expertise and experience. In 2023, L&D academies provided cutting-edge course content and enhanced participant knowledge, drawing a collective audience of over 600 investigative professionals. The Vehicle Crimes Academy delved into the complex world of vehicular fraud, while the Fraud Investigations Academy offered instruction related to detection and investigation techniques. The Workers’ Compensation Fraud Conference focused on innovative strategies against fraud. Together, these events underscored L&D’s commitment to setting a high standard in education and networking in the fight against insurance fraud.

On-Demand eLearning: NICTA

For over two decades, NICTA has served as the flagship eLearning platform that boasts engaging multimedia elements and relevant interactive content designed to empower learners and promote an environment of continuous learning. The global reach provided by NICTA ensures seamless access to over 60 courses, which are curated to provide content designed to address industry trends and high-impact, insurance-related crimes. In addition, NICTA is hosted on a robust learning management system that allows for real-time progress tracking, and over 40 courses are approved for continuing education credits to support professional credentials and certifications.

In 2023, L&D continued our efforts to ensure NICTA courses align with the latest industry trends, technological advancements, and evolving best practices. New and existing NICTA courses focused on user experience, and improvements were made to navigation, accessibility, narration, and media integration. In addition, learner feedback and review of data-driven metrics identified areas of improvement and enhancements. With an impressive 153,949 enrollments, a high satisfaction rating, and meticulously crafted courses, NICTA sets a standard of excellence and delivers unparalleled value to learners.

Regional Training Program

To capitalize on the extraordinary expertise and experience of the NICB workforce, L&D supports an extensive Regional Training program. This program is instrumental in providing unique and customized training opportunities for NICB members, law enforcement partners, and key stakeholders throughout NICB’s seven regions. Regional training offers a variety of flexible formats to include in-person workshops, engaging webinars, and immersive online courses. Each program covers a wide variety of insurance crime and fraud topics, and courses are co-created with partners to ensure expert knowledge with actionable insights. In addition, NICB instructors have successfully participated in an Instructor Development Certification program to facilitate best practices in education and training, and to ensure teaching methods accommodate the varied preferences and needs of learners.

In 2023, NICB realized a tremendous demand for regional training with over 1,500 hours of training provided to over 27,000 attendees. The unique instruction provided by the Regional Training program has been met with outstanding reviews and proven to be an effective tool in combating insurance crime.

Engaging With Partners

Paramount to the success and sustainability of L&D programs is an ongoing Partner Engagement program. These collaborative opportunities are driven by active participation, open communication, and a shared commitment to providing world-class insurance fraud and crime training. For 2023, this was accomplished through two complimentary committees comprised of members and industry representatives. Specifically, the Learning Committee focused on evolving trends in learning and innovative methods to upskill the workforce while the Workers’ Compensation Focus Group addressed training dedicated to fraudulent activities that undermine the integrity of the workers’ compensation system. These collaborative opportunities serve as a driving force to ensure enduring relationships and promote a landscape of up-to-date trends and strategies.

All said, 2023 was a transformative year for L&D. The commitment to providing innovative, relevant, and engaging learning experiences not only elevated the skills and knowledge of our learners but has positioned L&D for sustained excellence in a rapidly evolving landscape. The past year has been dedicated to elevating our learning programs and delivering innovative solutions to NICB members, law enforcement partners, and key stakeholders.

Looking ahead, we are excited to revolutionize our approaches, embracing cutting-edge technologies, and pioneering formats like microlearning and podcasts, and we remain steadfast to the principles of continuous improvement, adaptability, and an unwavering focus on the development of our courses and programs. L&D celebrates the achievements of the past year and eagerly anticipates the opportunities and challenges that the coming year will bring—confident in the ability to thrive and evolve through the power of learning and development.

Accomplishments

Public Affairs & Communications

The Public Affairs and Communications team at NICB serves as the insurance industry’s national voice on insurance fraud and crime. Our annual campaigns and programs are designed to educate, inform, and engage member companies, law enforcement partners, policymakers, news media, and the public to help prevent and deter insurance fraud.

In 2023, the team continued to be successful in our strategic objectives, while at the same time focusing on three major priorities: 1) refreshing NICB’s visual identity for the first time in decades; 2) creating a new member experience strategy to ensure members have a consistent experience with the NICB brand; and 3) expanding our public affairs initiatives to have an even stronger voice as the nation’s leader on insurance fraud.

Refreshing NICB’s Visual Identity

NICB continues to evolve as a data-driven, member-centric organization; however, our visual branding has remained the same for more than 30 years.

How we appear to our members and law enforcement partners through our logo, colors, fonts, etc., has been consistent since 1992 when NICB was formed through the merger of the National Automobile Theft Bureau and the Insurance Crime Prevention Institute. In 2023, the Marketing Communications team began the work to modernize our visual identity to reflect the evolution of NICB’s overall brand with our key stakeholder groups.

The team partnered with a branding agency in mid-2023 to conduct extensive research on NICB’s three-decade-old brand, including in-depth interviews with organizational leaders, employees, and partners. Through this effort, we developed a new brand story that explains who we are as an organization and why we exist, identified key brand attributes, and explored various options on what the new brand should “look like.”

In early 2024, we launched the new branding to our members, law enforcement partners, and the public. This included a brand launch video message shared with key stakeholders through email, social media, and on our website.

In the months to come, members and law enforcement partners will experience the new NICB brand in newly created communications, reports, and event promotions, as well as on a refreshed website and social media channels.

NICB’s visual identity will continue to evolve in coming years.

Building a Member Experience Strategy

How often do members want to hear from NICB? What do those communications look like, and what do they contain? What do members need from us? How do they want to be communicated with? What channels do they want to hear from us on? These are all questions Marketing Communications has been researching this past year.

In mid-2023, NICB hired an experienced marketing director who has an insurance industry background with the goal of not only helping to evolve NICB’s branding but also developing a new member experience strategy that will create a consistent experience for NICB’s members and law enforcement partners.

Early on in the research, the team identified ways to reduce email fatigue by decreasing the volume of emails being distributed while also focusing more attention on key initiatives and information relevant to members. This included combining messages with similar themes and topics into regular communications, utilizing different channels to reach certain subsets of our members, such as engaging with members in government affairs roles through platforms like LinkedIn, and sharing video messages that can combine multiple emails into a short 30- to 60-second clip.

In 2024, Marketing Communications will continue to refine and roll out a member experience strategy, utilizing new newsletters and digital channels in new, targeted ways to ensure members receive the right messages based on their overall job function.

Expanding Public Affairs Initiatives

In 2023, NICB continued to utilize data, intelligence, and partnerships to create impactful earned and paid media campaigns to educate, inform, and engage the public, member companies, lawmakers, trade associations, and the media on topics relevant to the insurance industry.

With vehicle thefts continuing to increase throughout the U.S. last year, NICB served as the primary source of information for the news media on topics related to vehicle thefts and carjackings, catalytic converter thefts, as well as contractor and medical fraud. As a result, NICB was featured in nearly 20,000 media stories last year, reaching over 2.6 billion people. This included a three-part series conducted by CBS News about stolen vehicles from the U.S. flowing over the border into Mexico. That series alone, which featured multiple segments with President and CEO David Glawe, aired on every CBS affiliate in the U.S. at least three times, and appeared multiple times on the network’s streaming news channel and social media platforms.

Similar crime- and fraud-related stories aired throughout the year on networks like Fox News, NBC News, and ABC News, and appeared in top-tier outlets, including The New York Times and Wall Street Journal.

Additionally, NICB expanded its public affairs efforts supporting Contractor Fraud Awareness Week (CFAW) in 2023. The awareness week, which originally was created by NICB as a social media campaign, has evolved into a multi-layered campaign involving various key stakeholders, including member companies, law enforcement, lawmakers and government leaders, the media, and consumers.

Last year, CFAW was recognized through official proclamations by leaders in 15 states, including New York, Illinois, Florida, and Georgia. This represents a 400% increase from the number of states that recognized CFAW in 2022. Even more states have expressed interest in issuing proclamations in 2024. Visit NICB.org/ContractorFraudWeek for more details.

NICB also partnered with key industry groups and national and state agencies to increase awareness of and engagement with this important week, including the American Property Casualty Insurance Association, Insurance Information Institute, AARP, as well as Florida’s Insurance Consumer Advocate and the New York Insurance Association.

In addition to proclamations and partnerships, NICB engaged in a national media tour with 18 media outlets across the U.S., resulting in more than 200 airings of news segments that reached more than 8.8 million people, as well as Facebook Live and Twitter Chat events with AARP and targeted social media and public service awareness (PSA) campaigns in both English and Spanish.

Accomplishments

Power of the NICB Brand

At NICB, our mission stands firm and our commitment to fighting fraud remains true. We have strong name recognition in the insurance industry and law enforcement community, and we want to build on that name with a solid brand presence.

As NICB has continued to introduce new, modern tools and processes to our members and partners, how our brand appears throughout all touch points and interactions with key stakeholders has not evolved to match the direction of the organization. The more modern NICB needs to be reflected in every aspect of how we appear to all those we serve.

In 2023, NICB partnered with a Pittsburgh-based branding agency to complete a diligent process to research and inform the creation of an evolved NICB brand. Through discovery sessions with leaders, employees, and key stakeholders, we developed the new NICB brand with a focus on how our members want and expect us to be there for them.

Impact of a Brand

Developing a new brand identity—or refreshing an existing one—requires time, effort, and money, but when done correctly, the impact on an organization is priceless. For NICB, the benefits have been immediate.

- Building Awareness: A strong brand creates our distinctive identity. With media and messaging barraging us daily, presenting a consistent brand helps carve out space to reach our members and partners. By consistently projecting the NICB brand through appropriate channels, we increase our visibility and ensure that our message resonates with members, law enforcement, lawmakers, and the public. The more familiar stakeholders become with our brand, the greater the likelihood of attracting new members and retaining existing ones.

- Credibility: Trust is the bedrock of any successful organization. A well-crafted brand not only sets expectations but also conveys reliability and trustworthiness. When our members consistently experience NICB’s values and see our employees carrying out our mission, it fosters a sense of credibility. This credibility, in turn, strengthens our relationships with members and enhances loyalty to NICB. When they see the NICB brand, they see the credibility of an organization forged on more than 110 years of commitment to fighting insurance fraud and crime.

- Professionalism: The NICB brand reflects our commitment to value and professionalism. A consistent brand presence not only identifies NICB, but it signals to our members that they are working with a reliable, credible, and professional organization. Those who work with us know the value we bring through the products and services we deliver.

More Than a Logo

On the surface, the new brand may seem like just a new logo, colors, and fonts. But the NICB brand is more than that. It is a promise to our members and law enforcement partners.

By understanding, embracing, and living our brand attributes, we not only strengthen NICB’s image but also create a profound and lasting impact on our members and law enforcement partners. By living the NICB brand and amplifying the successes of our organization, we commit to creating an even stronger NICB

Strategy, Policy, & Advocacy

NICB continued to advance our position as the thought leader on insurance crime and fraud issues for policymakers at the state, federal, and local level. Our Strategy, Policy, and Government Affairs (SPGA) team made unprecedented advances in our advocacy efforts in 2023. Among the most striking achievements: NICB testified 24 times before legislative bodies, cementing our footprint as the foremost insurance crime and fraud policy expert in the nation.

In addition, NICB held over 250 meetings with legislators and regulators, provided testimony 191 times, and helped enact 57 favorable bills.

NICB’s impact was highlighted in Florida where SPGA led an initiative to revise laws that have plagued the auto glass market there for years. NICB provided in-person testimony at five different committee hearings on both the House and Senate sides in support of reform measures. Working alongside industry representatives and other partners, NICB also helped found the “Fix the Cracks” initiative, a public affairs campaign to support and complement lobbying efforts. In coordination with Fix the Cracks, NICB’s President and CEO David Glawe published an op-ed in Florida Politics bringing attention to the growing auto glass fraud and abuse across Florida and calling for meaningful reform to the law.

As legislators across the country continued to advance consumer data privacy legislation, NICB worked exhaustively with lawmakers to articulate our mission and the need for protecting the flow of insurance fraud information through NICB between our members and our law enforcement partners. NICB is the only organization capable of securely housing, analyzing, and commingling all insurance claim data, law enforcement data, and third-party data because of our unique non-profit status and reputation for responsible data solutions. Through our advocacy efforts, NICB was able to secure entity-level exemptions in seven additional states where consumer data privacy laws were passed last year, expanding the total number of laws enacted with NICB exemptions to 10.

With vehicle thefts, carjackings, and catalytic converter thefts, unfortunately, remaining at historic highs, NICB was particularly active on those issues in jurisdictions across the country. A few of those highlights included:

- A suite of laws NICB helped enact in New Jersey that strengthened criminal penalties for auto thefts.

- First-in-the-nation legislation in Colorado that NICB supported making nearly all auto thefts felonies.

- In-person testimony NICB provided before the Georgia legislature to successfully enact a new auto theft prevention authority.

Georgia also passed favorable new catalytic converter legislation that featured NICB’s in-person testimony. NICB helped draft catalytic converter legislation in Delaware that was also enacted. NICB was also heavily involved in crafting and supporting the passage of legislation creating the first-ever state fraud unit in Wisconsin.

Finally, NICB created a Model Law that was presented at the National Conference of Insurance Legislators (NCOIL) at their summer and fall conferences. NICB continues to work with NCOIL to advance that model. NICB also presented at the Anti-Fraud Task Force meetings as part of the National Association of Insurance Commissioners’ (NAIC) Annual Conference.

NICB helped support our Public Affairs and Communications partners on NICB’s Contractor Fraud Awareness Week (CFAW) by securing proclamations formally recognizing CFAW in 15 different states—up from three the prior year.

Our external efforts were matched by significant improvements in the internal policy and compliance landscape and formulation of enterprise-wide strategies. SPGA launched NICB’s Data Governance Committee, finalized a new Cybersecurity Incident Response Plan, and improved our law enforcement access policy and implemented updated agreements with thousands of law enforcement partner relationships across the country.

The Office of the General Counsel (OGC) further complemented those efforts by continuing to successfully manage overall corporate risk through implementation of the Enterprise Risk Management Program, and by developing and implementing an audit program of member data vendors.

Accomplishments

Partner Engagement and Member Services

At the heart of our organization's success lies the dedication of the Partner Engagement and Member Services team in providing unparalleled customer service and outreach. Through personalized interactions, timely responses, and attendance at the insurance industry’s most notable events, the team has retained 99.5% of existing members—up 0.5% from 2022. This impressive figure underscores the trust and satisfaction our members place in our organization. It is a testament to the team's proactive approach and continuous efforts to address the evolving needs of our diverse membership base.

In 2023, the team successfully onboarded 18 new Active and Associate members and established two new Strategic Partners. These endeavors not only expanded our network into spaces like automotive telematics and roadside assistance but also enriched the collective expertise available to our members. The collaborative spirit fostered through these relationships positions us for even greater impact in the years to come.

2023 also saw the launch of the Member Activity Report. The adjusted report provides a more holistic value of NICB membership and draws focus to other membership components like our work in advocacy and government affairs and the legislative and regulatory activities in which NICB has participated.

The Partner Engagement and Member Services team also forged meaningful connections by attending 16 conferences nationwide. These events served as invaluable platforms to showcase our expertise, exchange ideas, and gather with current and potential members and partners. Our presence at these conferences not only enhanced our visibility but also reinforced our dedication to staying informed and involved.

In addition to national conferences, Partner Engagement and Member Services Vice President Dan Abbott represented NICB on the Executive Committee of the Global Insurance Fraud Summit and presented at the 2023 Summit in Edinburgh, Scotland. President and CEO David Glawe also presented at this conference and discussed transnational organized crime and the effect on the insurance industry. These invitations speak to NICB’s expertise and highlight the impact of our initiatives. The opportunity to share our insights with an international audience further solidifies our position as leaders in the insurance fraud fight.

Looking forward, the team remains committed to fostering community, expanding our network, and delivering top-notch service to our members. The successes of 2023 served as a strong foundation for the opportunities that lie ahead. Together, we will continue to grow, innovate, and make a lasting impact on the insurance industry and our members.

Accomplishments

Financial Statements

As a leader in the insurance fraud industry, NICB is honored by the relationships it maintains with

their 1,200 Active members plus Associate members and strategic partners. The challenges that lay

ahead demand responsible stewardship of resources and tools, as well as responsiveness, creativity,

and diverse talent and viewpoints. As NICB harnesses the power of data and advanced analytics, it

will enhance its dedication to fighting insurance fraud and crime.

These financial statements have been prepared by management in conformity with generally accepted accounting principles and include all adjustments which, in the opinion of management, are necessary to reflect a fair presentation. This presentation represents a summarization from audited financial statements. Certain reclassifications of prior year amounts have been made to conform to current year presentation.

Statements of Financial Position

| Assets | |

|---|---|

| Current assets | |

| 2023 | $16,973,991 |

| 2022 | $17,704,605 |

| Investments | |

| 2023 | 58,067,535 |

| 2022 | 50,572,686 |

| Property and equipment, net | |

| 2023 | 1,717,310 |

| 2022 | 3,894,544 |

| Right-of-use-assets, net | |

| 2023 | 5,343,238 |

| 2022 | 3,894,544 |

| Other assets | |

| 2023 | 89,063 |

| 2022 | 101,569 |

| TOTAL ASSETS | |

| 2023 | $82,191,137 |

| 2022 | $72,773,750 |

| Assets | 2023 | 2022 |

|---|---|---|

| Current assets | $16,973,991 | $17,704,605 |

| Investments | 58,067,535 | 50,572,686 |

| Property and equipment, net | 1,717,310 | 3,894,544 |

| Right-of-use-assets, net | 5,343,238 | 3,894,544 |

| Other assets | 89,063 | 101,569 |

| TOTAL ASSETS | $82,191,137 | $72,773,750 |

| Liabilities and Net Assets | |

|---|---|

| Current liabilities | |

| 2023 | $11,955,188 |

| 2022 | $10,001,394 |

| Operating lease obligations, net of current portion | |

| 2023 | 4,095,332 |

| 2022 | 2,169,970 |

| Other long-term liabilities | |

| 2023 | 23,624 |

| 2022 | 72,061 |

| Accrued post-retirement benefits, net of current portion | |

| 2023 | 13,433,000 |

| 2022 | 12,285,000 |

| TOTAL LIABILITIES | |

| 2023 | 29,507,144 |

| 2022 | 24,528,425 |

| NET ASSETS WITHOUT DONOR RESTRICTIONS | |

| 2023 | 56,625,417 |

| 2022 | 48,233,951 |

| NET ASSETS WITH DONOR RESTRICTIONS | |

| 2023 | 58,576 |

| 2022 | 11,374 |

| TOTAL LIABILITIES AND NET ASSETS | |

| 2023 | 82,191,137 |

| 2022 | 72,773,750 |

| Liabilities and Net Assets | 2023 | 2022 |

|---|---|---|

| Current liabilities | $11,955,188 | $10,001,394 |

| Operating lease obligations, net of current portion | 4,095,332 | 2,169,970 |

| Other long-term liabilities | 23,624 | 72,061 |

| Accrued post-retirement benefits, net of current portion | 13,433,000 | 12,285,000 |

| TOTAL LIABILITIES | 29,507,144 | 24,528,425 |

| NET ASSETS WITHOUT DONOR RESTRICTIONS | 56,625,417 | 48,233,951 |

| NET ASSETS WITH DONOR RESTRICTIONS | 58,576 | 11,374 |

| TOTAL LIABILITIES AND NET ASSETS | 82,191,137 | 72,773,750 |

Statements of Activities

| Revenue | |

|---|---|

| Assessments and member services | |

| 2023 | $60,597,340 |

| 2022 | $57,579,264 |

| Geospatial member assessment | |

| 2023 | 5,104,118 |

| 2022 | 10,920,666 |

| Data related and strategic partnership | |

| 2023 | 1,934,722 |

| 2022 | 1,808,997 |

| Miscellaneous income | |

| 2023 | 636,436 |

| 2022 | 417,259 |

| Net assets released from restriction | |

| 2023 | 23,593 |

| 2022 | 10,478 |

| Loss on disposal of property and equipment | |

| 2023 | - |

| 2022 | - |

| Investment return, net for operations | |

| 2023 | 1,640,050 |

| 2022 | 1,394,664 |

| TOTAL REVENUE | |

| 2023 | $69,936,259 |

| 2022 | $72,131,328 |

| Revenue | 2023 | 2022 |

|---|---|---|

| Assessments and member services | $60,597,340 | $57,579,264 |

| Geospatial member assessment | 5,104,118 | 10,920,666 |

| Data related and strategic partnership | 1,934,722 | 1,808,997 |

| Miscellaneous income | 636,436 | 417,259 |

| Net assets released from restriction | 23,593 | 10,478 |

| Loss on disposal of property and equipment | - | - |

| Investment return, net for operations | 1,640,050 | 1,394,664 |

| TOTAL REVENUE | $69,936,259 | $72,131,328 |

| Expenses | |

|---|---|

| Salaries | |

| 2023 | $37,204,949 |

| 2022 | $34,427,633 |

| Employee and retiree benefits | |

| 2023 | 11,019,295 |

| 2022 | 10,531,171 |

| Technical fees and services | |

| 2023 | 6,725,727 |

| 2022 | 5,971,911 |

| Geospatial imagery | |

| 2023 | 5,104,118 |

| 2022 | 10,920,666 |

| Automobile operations | |

| 2023 | 1,891,252 |

| 2022 | 1,832,577 |

| Office expense | |

| 2023 | 1,357,957 |

| 2022 | 1,314,209 |

| Computer and equipment maintenance | |

| 2023 | 1,160,867 |

| 2022 | 1,097,431 |

| Travel and group meetings | |

| 2023 | 1,149,191 |

| 2022 | 832,593 |

| Insurance | |

| 2023 | 1,044,272 |

| 2022 | 936,656 |

| Other | |

| 2023 | 3,484,636 |

| 2022 | 3,059,987 |

| TOTAL EXPENSES | |

| 2023 | $70,142,264 |

| 2022 | $70,924,834 |

| Change in net assets with donor restrictions from operations | |

| 2023 | ($206,005) |

| 2022 | $1,206,494 |

| Non-operating changes in net assets without donor restrictions | |

| 2023 | |

| 2022 | |

| Loss on disposal of property and equipment | |

| 2023 | (7,159) |

| 2022 | - |

| Investment return, net for operations | |

| 2023 | (1,640,050) |

| 2022 | (1,394,664) |

| Investment return, net | |

| 2023 | 7,507,680 |

| 2022 | (7,286,067) |

| Change in net assets without donor restrictions before post-retirement-related changes other than net periodic post-retirement costs | |

| 2023 | $5,654,466 |

| 2022 | ($7,474,237) |

| Post-retirement related changes other than net periodic post-retirement costs | |

| 2023 | (1,263,000) |

| 2022 | 5,368,000 |

| TOTAL CHANGE IN NET ASSETS WITHOUT DONOR RESTRICTIONS | |

| 2023 | 4,391,466 |

| 2022 | (2,106,237) |

| Contributions | |

| 2023 | 70,795 |

| 2022 | 11,315 |

| Net assets released from restriction | |

| 2023 | (23,593) |

| 2022 | (10,478) |

| Total change in net assets with donor restrictions | |

| 2023 | 47,202 |

| 2022 | 837 |

| CHANGE IN NET ASSETS | |

| 2023 | 4,438,668 |

| 2022 | (2,105,400) |

| Net assets, beginning of year | |

| 2023 | 48,245,325 |

| 2022 | 50,350,725 |

| Net assets, end of year | |

| 2023 | 52,683,993 |

| 2022 | 48,245,325 |

| Expenses | 2023 | 2022 |

|---|---|---|

| Salaries | $37,204,949 | $34,427,633 |

| Employee and retiree benefits | 11,019,295 | 10,531,171 |

| Technical fees and services | 6,725,727 | 5,971,911 |

| Geospatial imagery | 5,104,118 | 10,920,666 |

| Automobile operations | 1,891,252 | 1,832,577 |

| Office expense | 1,357,957 | 1,314,209 |

| Computer and equipment maintenance | 1,160,867 | 1,097,431 |

| Travel and group meetings | 1,149,191 | 832,593 |

| Insurance | 1,044,272 | 936,656 |

| Other | 3,484,636 | 3,059,987 |

| TOTAL EXPENSES | $70,142,264 | $70,924,834 |

| Change in net assets with donor restrictions from operations | ($206,005) | $1,206,494 |

| Non-operating changes in net assets without donor restrictions | ||

| Loss on disposal of property and equipment | (7,159) | - |

| Investment return, net for operations | (1,640,050) | (1,394,664) |

| Investment return, net | 7,507,680 | (7,286,067) |

| Change in net assets without donor restrictions before post-retirement-related changes other than net periodic post-retirement costs | $5,654,466 | ($7,474,237) |

| Post-retirement related changes other than net periodic post-retirement costs | (1,263,000) | 5,368,000 |

| TOTAL CHANGE IN NET ASSETS WITHOUT DONOR RESTRICTIONS | 4,391,466 | (2,106,237) |

| Contributions | 70,795 | 11,315 |

| Net assets released from restriction | (23,593) | (10,478) |

| Total change in net assets with donor restrictions | 47,202 | 837 |

| CHANGE IN NET ASSETS | 4,438,668 | (2,105,400) |

| Net assets, beginning of year | 48,245,325 | 50,350,725 |

| Net assets, end of year | 52,683,993 | 48,245,325 |

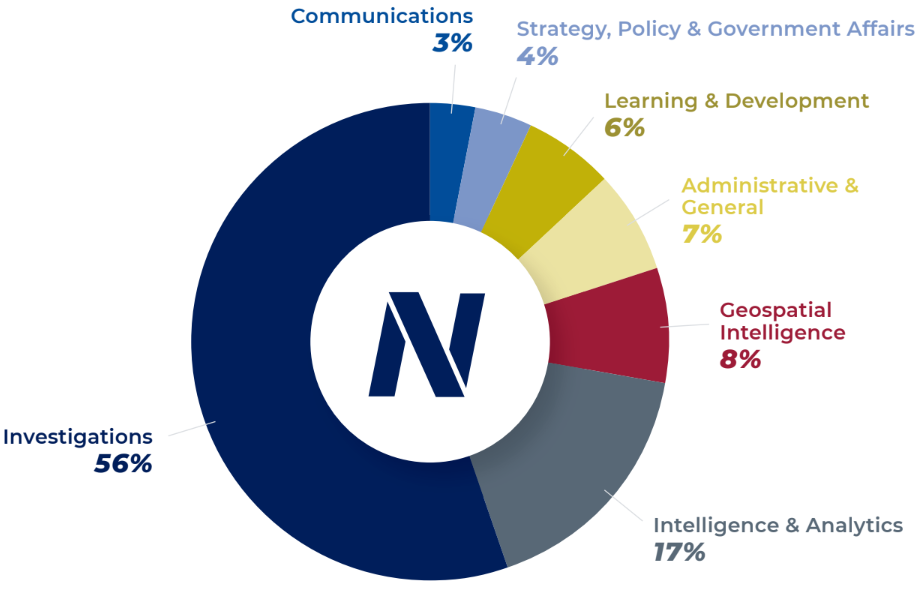

Functional Program Expenses

| Program Services | |

|---|---|

| Investigations | |

| 2023 | $39,228,600 |

| 2022 | $36,861,229 |

| Geospatial Intelligence | |

| 2023 | 5,275,358 |

| 2022 | 11,078,398 |

| Intelligence & Analytics | |

| 2023 | 11,591,699 |

| 2022 | 10,382,498 |

| Learning & Development | |

| 2023 | 4,084,273 |

| 2022 | 3,720,046 |

| Strategy, Policy & Government Affairs | |

| 2023 | 2,638,326 |

| 2022 | 2,504,354 |

| Communications | |

| 2023 | 2,179,695 |

| 2022 | 1,832,993 |

| TOTAL PROGRAM SERVICES | |

| 2023 | $64,997,951 |

| 2022 | $66,379,518 |

| Administrative and General | |

| 2023 | 5,144,313 |

| 2022 | 4,545,316 |

| TOTAL FUNCTIONAL EXPENSES | |

| 2023 | $70,142,264 |

| 2022 | $70,924,834 |

| Program Services | 2023 | 2022 |

|---|---|---|

| Investigations | $39,228,600 | $36,861,229 |

| Geospatial Intelligence | 5,275,358 | 11,078,398 |

| Intelligence & Analytics | 11,591,699 | 10,382,498 |

| Learning & Development | 4,084,273 | 3,720,046 |

| Strategy, Policy & Government Affairs | 2,638,326 | 2,504,354 |

| Communications | 2,179,695 | 1,832,993 |

| TOTAL PROGRAM SERVICES | $64,997,951 | $66,379,518 |

| Administrative and General | 5,144,313 | 4,545,316 |

| TOTAL FUNCTIONAL EXPENSES | $70,142,264 | $70,924,834 |

Notes to Financial Statements

ASSESSMENT REVENUES

The activities of the National Insurance Crime Bureau (“NICB”), conducted principally in the United States, are financed through assessments of its member insurance carriers. Such assessments are determined according to a formula based upon gross premiums for certain lines of business written by member companies and annual verification received from them. During the years ended December 31, 2023 and 2022, nine member organizations made up approximately 55% of NICB’s assessment and member service revenues.

RECEIVABLES — ASSESSMENTS AND RELATED

NICB adopted ASU 2016-13 effective January 1, 2023. NICB’s accounts receivable consist of assessments, international operations and data-related activities. Accounts receivables are due based on contract terms and stated at amounts due from members net of an allowance for credit losses. Accounts outstanding longer than the contractual payment terms are considered past due. NICB determines its allowance for credit losses by considering a number of factors, including the length of time past due, NICB’s past write-off history, reasonable and supportable forecasts, the member’s current ability to pay, and the condition of the general economy and industry as a whole. NICB writes off accounts receivable when they become uncollectible, and payments subsequently received on such receivables are credited to the allowance for credit losses.

NET ASSETS

NICB has net assets with donor restrictions which represent contributions subject to donor-imposed restrictions. These contributions are designated for special operations in support of law enforcement and fraud fighting activities. Net assets without donor restrictions are not subject to donor-imposed stipulations or time restrictions.

GEOSPATIAL INTELLIGENCE

Geospatial Intelligence was developed to provide the insurance industry and others with comprehensive geospatial imagery “Gray Sky” and analytics related to natural or manmade catastrophic events that members may use to deal with insurance claims and prevent fraud. The program platform delivers catastrophe monitoring and response, comprehensive “Blue Sky” aerial imagery coverage of the United States, and advanced analytics to include pre- and post-damage assessment to its members; leading to more claims decisions, reduction of fraud, and faster catastrophe response. The scope of the program is dependent on special assessments from its members. Some NICB members still participate in this program, but revenue and expenses has reduced from 2022 to 2023 as the majority of the program billing has been transferred to GIC. NICB expended $5,275,358 and $11,078,398 to support the existing program, which includes $171,240 and $157,732 of indirect costs for the years ended December 31, 2023, and 2022, respectively.

LEASES

NICB has operating lease agreements for office space and vehicles with lease terms ranging from 1 to 11 years. As permitted within the guidance of ASC 842, NICB has elected to use a risk-free rate for all leases, using a period comparable with that of the lease term. In September 2023, NICB executed a lease agreement to relocate the Headquarters operation from Des Plaines, IL to Oak Brook, IL which is reflected in the 2023 lease obligation.

NICB POST-RETIREMENT PLAN

NICB provides certain healthcare and life insurance benefits for retired employees. Employees hired prior to April 1, 2004 are eligible to receive this benefit. The NICB Post-retirement Plan is unfunded. As of December 31, 2023, recognition of the net unfunded status of the NICB Post-retirement Plan resulted in current liabilities of $800,000 and non-current liabilities of $13,433,000 for a total benefit obligation of $14,233,000.

LITIGATION

NICB has been named as a defendant in certain lawsuits wherein the plaintiffs seek to recover damages based upon various allegations arising from certain of these organizations’ investigations. After considering the merits of these actions and the opinions of outside counsel, together with the organizations’ liability insurance coverage, management of NICB believes that the ultimate liability for these matters, if any, will not have a material adverse effect on the NICB financial statements.

TAX STATUS

NICB has received a favorable determination letter from the Internal Revenue Service dated September 9, 1991, and reaffirmed in 2001, stating that it qualifies as a not-for-profit corporation as described in Section 501(c)(4) of the Internal Revenue Code (IRC) and, as such, is exempt from federal income taxes on related income pursuant to Section 501(a) of the IRC. NICB continues to qualify as a not-for-profit corporation under Section 501(c)(4).